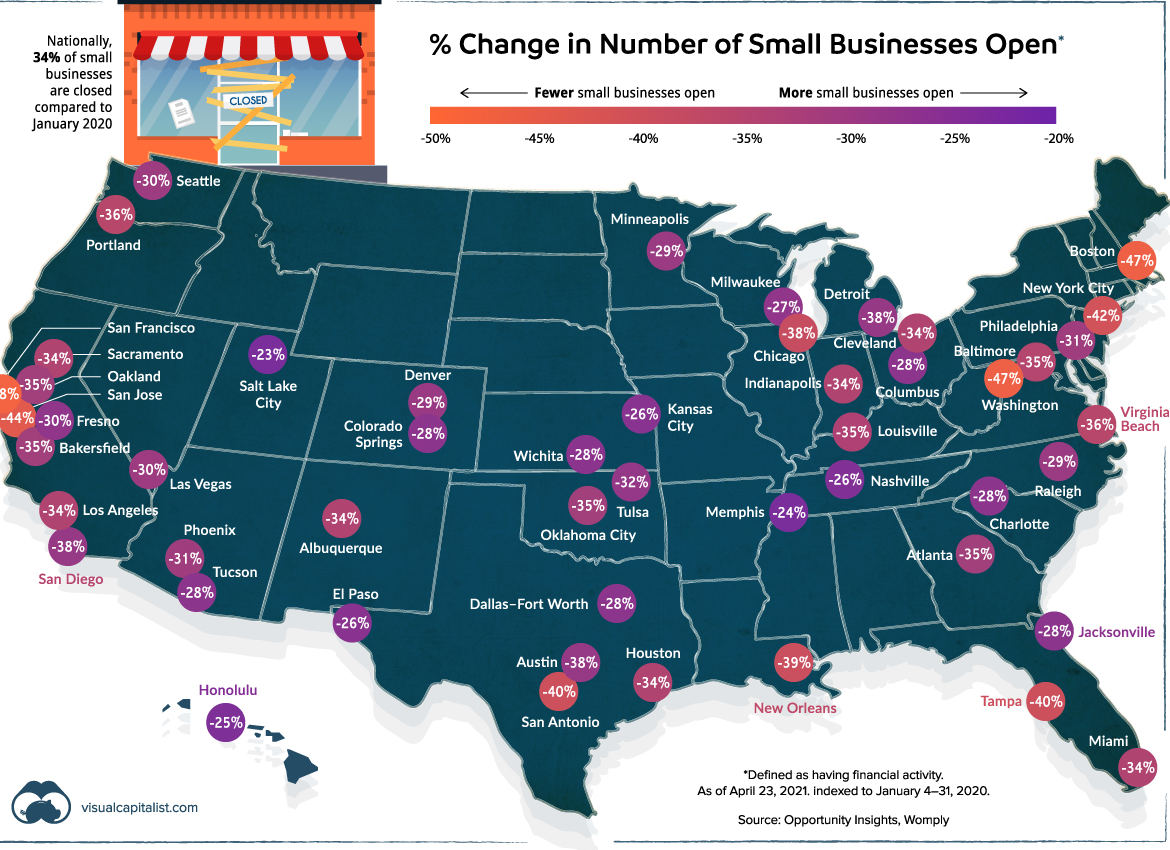

The Shortage at Grocery Stores

Since the onset of the COVID-19 pandemic, grocery store sales (adjusted for inflation) have averaged ~12% above their 2018 levels, which is a very sharp increase.

Inventories haven’t kept up with sales. This can be seen in the ratio of inventories to sales for food and beverage stores (grocery stores are the largest subset of these stores, unfortunately data on monthly retail inventories is not reported by the Census Bureau). Since the onset of the pandemic, the ratio of inventories to sales has fallen from ~0.79 to ~0.73, which represents a 7.6% decline (which is very substantial over a short period). This means grocery stores are turning their inventories substantially faster than before.

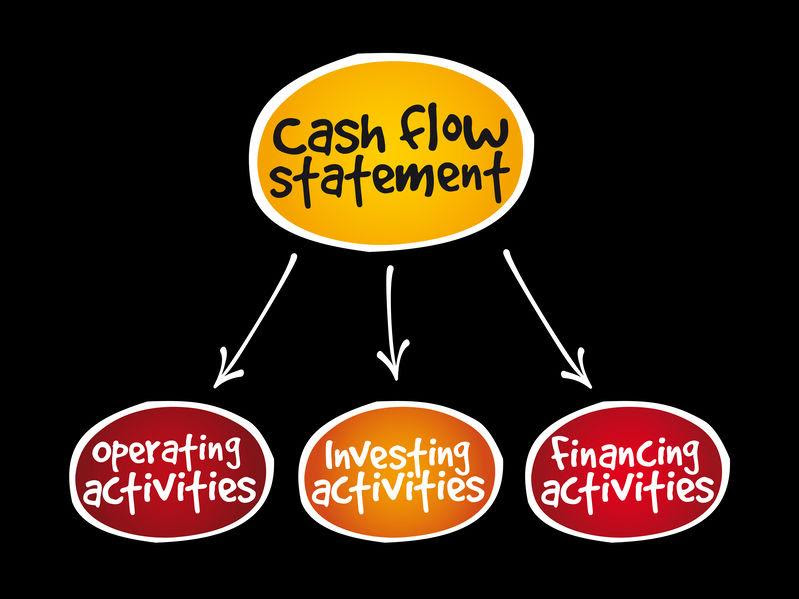

SCL provides a Honest & Easy approach to equipment financing

SCL provides a Honest & Easy approach to equipment financing