Get ready for your best year!

SCL is Open- We have been helping our customers during the Government Shutdown to get the loans they need

Many businesses are feeling the harsh effect of the government shutdown. Most importantly, obtaining a SBA loan that is currently inactive. Economists estimate $2 billion in funding that is already been delayed.

Since 1992 SCL has always been a lender that supports our clients and their need to grow and acquire capital.

We are here to assist our clients that are in a holding pattern during this shutdown.

Working Capital Loan for short term lending

About SCL

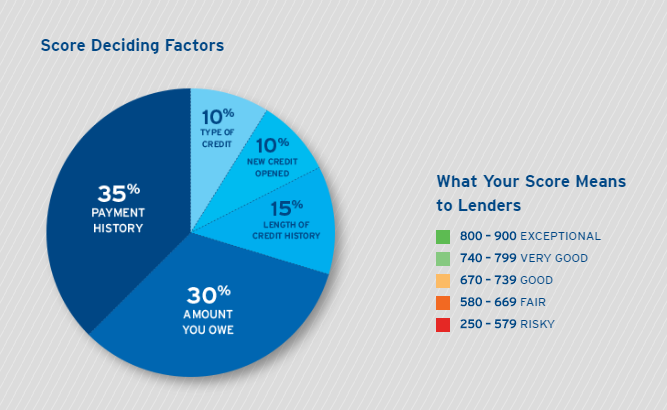

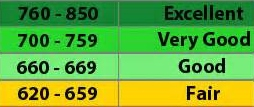

Credit Scores

Credit Scores