FED Hold Interest Rate

FED keeps Rates Stable

News From SCL Equipment Finance

At the June 12th Federal Reserve meeting, Chair Jerome Powell announced that the benchmark lending rate will remain at its current level. Rates are stable for now.

As we enter the third quarter of 2024, we are seeing an increasing trend among our clients investing in equipment to streamline their processes through automation. Rates are still low when you finance equipment.

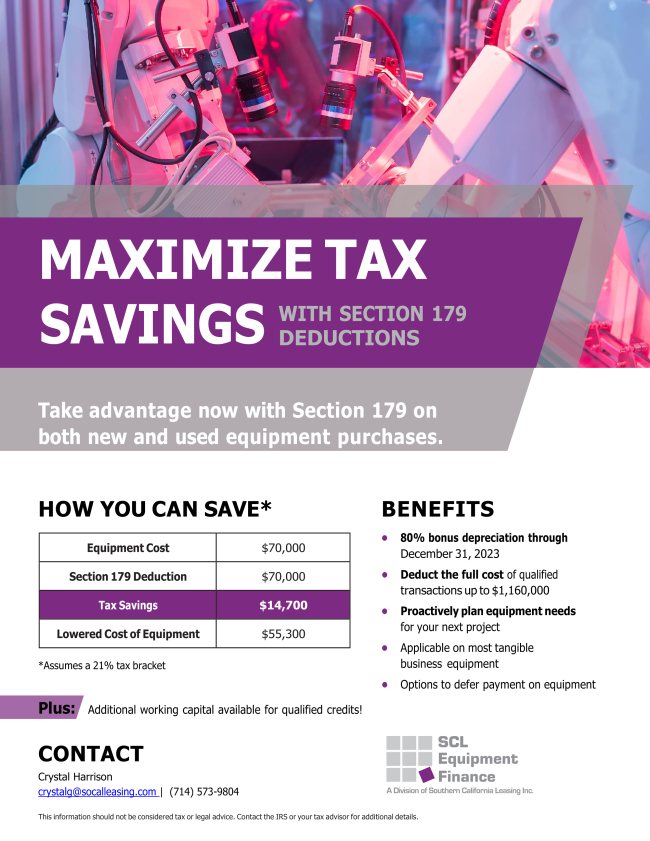

WHY YOU SHOULD THINK ABOUT SECTION 179?

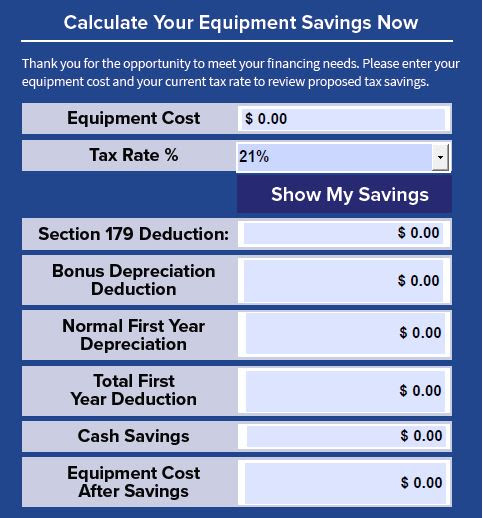

In a nutshell, Section 179 of the IRS Tax Code allows you to deduct all of the cost of qualifying equipment purchases in the tax year when you make the purchase.

What is your payment for your next equipment purchase?

Use our friendly online calculator to get an estimate of your next equipment purchase monthly payment. Please keep in mind this is an estimate only and could change due to credit.