- The Section 179 deduction is anticipated to remain at $1,160,000 providing a valuable tax incentive for companies investing in new equipment

- Interest rates are projected to decrease

- Businesses will still face challenging credit underwriting conditions, making it imperative to navigate these hurdles effectively

- Financing will allow companies to conserve working capital and get the equipment they need to automate

Many U.S. businesses are increasingly seeking automation solutions to reduce labor costs and enhance operational efficiency in this environment.

The Growth of Subscription-Based Business Models

Subscription-based business models will continue to grow in popularity as companies seek to create stable, recurring revenue streams. For credit markets, this shift means that lenders may place more emphasis on the predictable cash flows of businesses with subscription models than actual current financials.

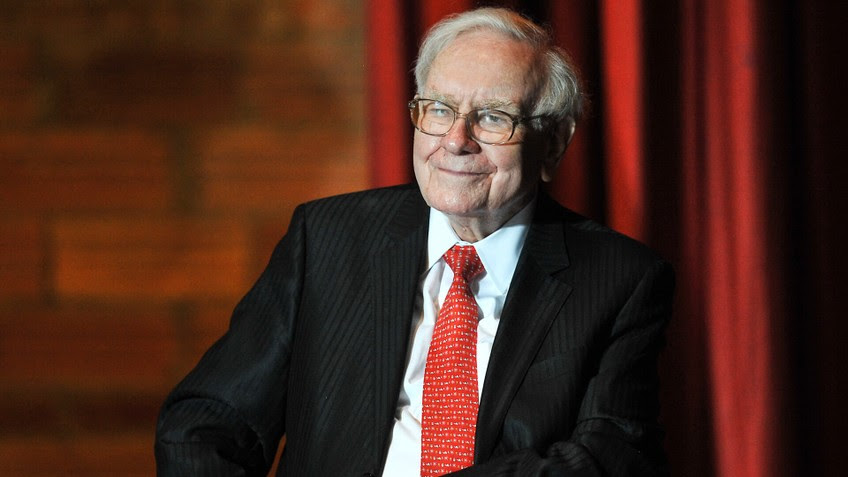

Warren Buffett’s Views on Small Businesses

Warren Buffett’s views on small businesses emphasize the importance of solid fundamentals, ethical leadership, long-term thinking, and financial discipline. For small business owners in 2025 and beyond.