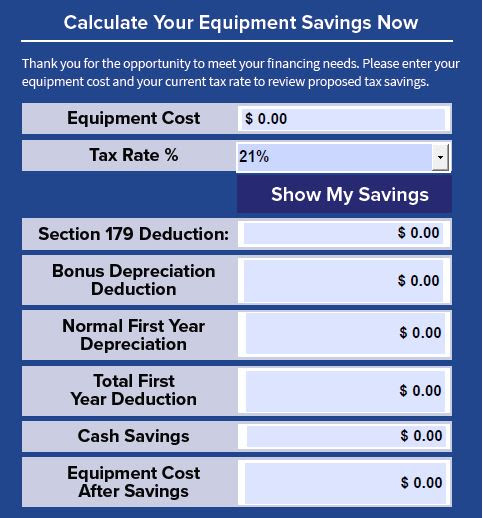

TAX BENEFITS EQUIPMENT PURCHASES 2024

Section 179 is a tax code that allows businesses to deduct the full purchase price of qualifying equipment purchased or financed during the tax year. By taking advantage of Section 179, businesses can significantly reduce your taxable income and save money on their equipment purchases. This tax incentive is designed to encourage businesses to invest in their growth and development by making it more affordable to acquire the assets they need. For businesses looking to upgrade or expand their equipment in 2024, understanding and utilizing Section 179 can lead to substantial savings and financial benefits. Make sure to consult with your tax advisor to see how you can leverage this tax provision for your equipment purchases in 2024.